Exclusively For Doctors, Surgeons, Dentists & All Medical Specialists

Build Wealth Like The Most Successful Medical Professionals, Using Exclusive Lending Strategies & Tax Structures Only Available To Healthcare Specialists — Unlocking Strategic Property Investment Leverage + $20K–$50K In Annual Tax Savings

The Smart, Structured Finance Strategy Successful Medical Professionals Rely On To Build Long-Term Wealth — Without Extra Work, Investment Risk, Or Loan Structure Complexity

MedInvest Is Engineered Exclusively For Medical Professionals Because Your Income, Risk Profile, And Lender Access Are Completely Different To The General Public.

Book Your Private Strategy Call Now — And Discover The Wealth Building Tactics Most Medical Professionals Never Even Hear About

We Build Strategic Wealth Systems Specifically For Medical Professionals…

Implement The Exact MedInvest Strategy That’s Helped Dozens Of Specialists Save $20K–$50K+ In Tax Annually While Building Passive Wealth — Without Extra Work Or Risk

As a high-income medical professional, you need more than just basic financial advice — you need a hands-off, profession-specific wealth system that protects your time, cuts unnecessary tax, and builds long-term income. MedInvest delivers exactly that.

Here’s Exactly What We Build For You In The First 30 Days:

Your Personalised Wealth & Tax Strategy

We begin with a private strategy session tailored specifically to your income, tax profile, and financial goals.

This isn’t generic advice — we map out exactly how to reduce your tax burden by $20K–$50K+ per year while setting up the foundations for long-term passive wealth.

Every strategy is profession-specific and structured to protect your time, eliminate unnecessary admin, and deliver measurable outcomes.

Your Profession-Specific Lending Framework

You’ll gain access to exclusive, high-leverage opportunities that are only available to medical professionals.

These aren’t off-the-shelf products — we custom-structure finance solutions that maximise your borrowing power, reduce tax exposure, and support long-term wealth growth.

This opens the door to powerful, high-performance investments while protecting your cash flow and removing the typical friction associated with traditional lending.

Full-Service Execution (So You Don’t Lift A Finger)

We take the strategy and handle every step of the implementation — applications, lender negotiations, structuring, and approvals.

This done-for-you execution means zero time wasted chasing paperwork or dealing with banks.

Your entire wealth-building process runs in the background, while you stay focused on your career and lifestyle.

Ongoing Portfolio Growth Support

Once your initial investments are in place, we don’t stop there. Our expert advisory team provides ongoing strategic input to help scale your portfolio and optimise performance.

We identify new opportunities, review and adjust strategies, and ensure your investment pathway stays aligned with your financial objectives.

It’s like having a private CFO on-call — but tailored exclusively for medical professionals.

A Wealth System That Runs Without You

The ultimate outcome? A fully managed wealth-building engine that works in the background while you continue doing what you do best.

With our complete system in place — from tax strategy and lending to portfolio growth — you’re no longer just earning high income, you’re leveraging it to build lasting wealth.

And the best part? It’s completely hands-off. No guesswork. No extra workload. Just results.

From The Desk Of The

Joshua Zyffert

Senior Broker, YBR Edmondson Park

Medical Investment Finance Specialist

The biggest financial mistake high-earning medical professionals make — often without even knowing it?

Bleeding away $20K–$50K+ in avoidable tax every single year and parking their income in low-yield savings accounts… instead of building true, strategic wealth.

You’ve worked hard for your income. But here’s the reality:

Most doctors, surgeons, specialists, and consultants are left in the dark when it comes to how to leverage their income with smart structuring and exclusive lending — because traditional accountants and brokers simply don’t understand your professional profile or what’s actually possible.

The truth? It’s not your fault.

You’re already at capacity — managing patients, schedules, and everything in between. You don’t have the time (or desire) to become a property expert, tax strategist, or lending negotiator. And you shouldn’t have to.

You’ve probably seen financial advice before...

“Talk to your accountant.”

“Invest in another managed fund.”

“Buy an IP when the market cools.”

But none of it addresses the root problem:

You need a system built specifically for your profession — one that’s done-for-you, backed by data, and built to save you serious tax and grow your wealth hands-free.

That’s exactly where MedInvest comes in.

We handle everything — strategy, lending, structuring, implementation, and ongoing portfolio growth — so you can transform from high-income earner to high-net-worth investor without ever compromising your time or lifestyle.

We don’t just give advice.

We build a fully managed wealth engine tailored to your career and your financial future.

And it starts with your first strategy session.

"We Take This High-Performance Wealth-Building System And Tailor It Specifically To Your Financial Profile As A Medical Professional"

You don’t need to become a tax strategist, property investor, or lending expert — that’s our job. Wealth-building is our area of expertise, and MedInvest was built specifically to serve high-income medical professionals just like you.

Having worked exclusively with doctors, surgeons, specialists, and consultants earning $200K+, we know exactly what works to reduce your tax liability and grow your net worth — without risk, stress, or added workload.

We've built the backend systems, lending access, and strategic frameworks to deliver results quickly and predictably.

Could you figure this out on your own? Maybe. You could hire a broker, speak to an accountant, do your own research, and test your way through years of costly trial and error.

Or — you could shortcut all of that by partnering with professionals who’ve already done it, repeatedly, with proven systems designed around your profession.

This isn’t general advice. This is a done-for-you wealth strategy tailored to your income, structured around your lifestyle, and built to deliver measurable financial transformation — fast.

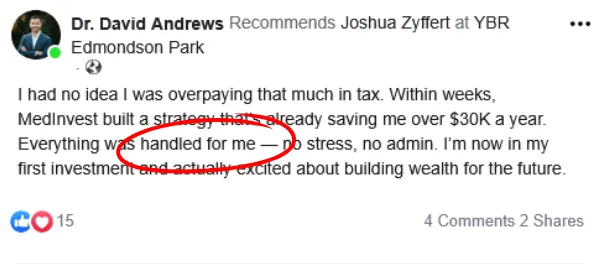

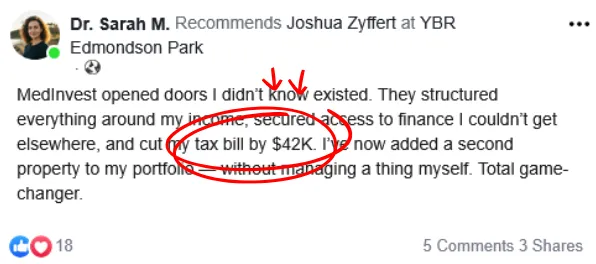

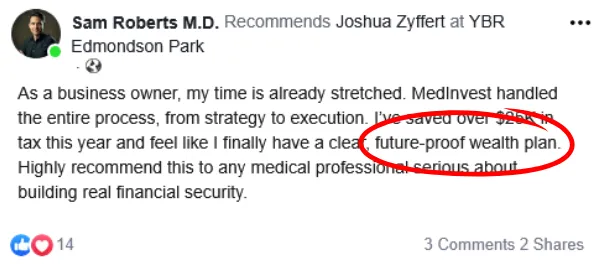

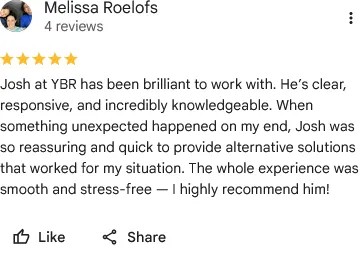

But Don't Just Take Our Word For It....

Execution Case Studies

Saved $43,700 In Tax And Acquired A $1.2M Investment Property With Zero Admin

This Sydney-based surgeon was earning over $400K per year but was unknowingly losing tens of thousands in tax and sitting on idle savings. After a private strategy session, we implemented a MedInvest Wealth Blueprint tailored to his income and long-term financial goals.

We restructured his finances for maximum tax efficiency and secured access to a profession-only lending product that allowed him to purchase a $1.2M high-growth investment property with minimal cash outlay. Our team handled the entire process — from loan structuring and applications to approvals and execution.

Within the first 90 days, he saved $43,700 in tax, improved his borrowing capacity, and secured a high-performing asset that is now generating passive income — all without lifting a finger or losing time from his practice.

This is a repeatable system designed to protect your income, grow your wealth, and keep you in full control of your financial future.

We Personally Use The MedInvest System Ourselves — Because It Works

We don’t just recommend this system — we use it ourselves. Every strategic framework, lending product, and tax structure we deploy for our clients is the same approach we’ve used to grow a multi-property portfolio, reduce tax exposure, and build long-term financial independence.

This system was developed through years of hands-on experience, constant refinement, and collaboration with top-tier lenders, financial planners, and property analysts — all tailored around the unique financial profiles of high-income professionals.

The results? Consistent portfolio growth, optimised tax outcomes, and a clear, repeatable process that delivers measurable results — year after year. When you book your strategy session with us, we show you exactly how the MedInvest system works behind the scenes, and how it can be customised to build serious long-term wealth — just like we’ve done for ourselves.

"Build Long-Term Wealth And Save $20K–$50K+ In Tax Every Year With A Profession-Specific, Done-For-You System"

The key to financial freedom as a medical professional isn’t earning more — it’s keeping more and putting your income to work intelligently.

With MedInvest, you’ll leverage a proven, hands-off wealth-building system designed exclusively for doctors and specialists earning $200K+.

In just 30 days, we implement your tailored financial strategy — from tax structuring and exclusive lending access to full-service execution — so you can reduce your tax, build an income-producing portfolio, and grow long-term wealth without lifting a finger.

Learn How To Save $20K–$50K+ In Tax Each Year And Build A High-Growth Investment Portfolio — Without Adding To Your Workload

Stop letting the ATO take more than necessary. With MedInvest, you’ll implement professionally structured strategies to reduce your annual tax bill by tens of thousands — and redirect those savings into a fully managed, income-producing investment portfolio.

We handle everything for you: from smart tax planning and profession-only lending access to full-service execution and portfolio growth.

This is the smarter, safer way for high-income medical professionals to build long-term wealth — without risk, without admin, and without sacrificing your time.

The MedInvest Wealth Strategy Process

Strategic Discovery Session

We start by getting absolute clarity on your income, goals, and tax profile.

This isn’t a cookie-cutter approach — it’s a deep dive into your financial position to uncover missed opportunities and identify exactly how much tax you can legally eliminate.

This becomes the foundation for a wealth plan built around you and your profession.

Your Custom Wealth Blueprint

Once we understand your position, we build a tailored strategy designed to reduce tax and grow long-term wealth through property.

Every move is mapped out for maximum leverage and long-term efficiency, using structures designed specifically for medical professionals earning $200K+.

No fluff — just a clear pathway to stronger financial outcomes.

Exclusive Lending Access

Here’s where the real leverage begins. You’ll gain access to premium, profession-only lending products with better terms, higher borrowing capacity, and streamlined approvals.

We structure everything for optimal tax outcomes and long-term asset growth — far beyond what most brokers or banks will ever show you.

Full-Service Execution

We handle the entire process end to end. From loan applications and structuring to approvals and negotiations — it’s all done for you.

No paperwork. No phone tag. No back and forth with banks. You focus on your practice, while we handle the backend to put your plan into action.

Ongoing Portfolio Growth & Support

Once the first investment is in motion, we don’t stop. You’ll get ongoing strategic support to grow, optimise, and refine your portfolio over time.

From refinancing opportunities to new acquisitions, we help you scale your wealth safely and consistently — with zero stress and full visibility.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

What exactly is MedInvest?

MedInvest is a done-for-you wealth strategy system designed exclusively for high-income medical professionals. We combine tax-efficient structuring, profession-only lending products, and expert execution to help you save $20K–$50K+ in tax each year and build a growing, income-producing investment portfolio — all without adding to your workload.

Who is MedInvest best suited for?

Our service is designed for doctors, surgeons, specialists, and medical professionals earning $200K+ per year who want to stop overpaying tax and start building long-term wealth. If you’re time-poor, financially successful, and want your money working harder for you, MedInvest is built precisely for your situation.

How is this different from working with a financial planner or accountant?

Traditional financial planners and accountants typically offer general advice or basic tax returns. MedInvest goes far beyond that. We create and execute a strategic wealth plan — including tax structuring, exclusive lending access, and full property acquisition support — all done for you, start to finish. We don’t just advise; we build and manage your wealth system.

How much time will I need to invest in the process?

Very little. We respect how busy medical professionals are, so our system is designed to be 100% hands-off. After your initial strategy session (around 60–90 minutes), we handle all the research, paperwork, structuring, and negotiations for you. You’ll simply review key decisions while we manage everything else.

How involved do I need to be in the process?

Very minimally. MedInvest is designed for busy medical professionals who don’t have time to manage their own financial strategy. After your initial strategy session, we take over the heavy lifting — from structuring and lender negotiations to paperwork, execution, and ongoing portfolio support.

You stay informed and in control of key decisions, but the day-to-day management is entirely handled for you. This means you can grow your wealth, reduce tax, and access exclusive finance strategies — without sacrificing time or mental bandwidth.

How soon will I start seeing results?

Many clients begin seeing measurable tax savings — often between $20K–$50K — within their first financial year. Portfolio growth begins once your lending and acquisition strategy is in place, typically within 60–90 days of your initial session.

Do I need any previous investment experience?

Not at all. Most of our clients come to us with minimal investment experience. Our team manages everything — from structuring and financing to property selection and ongoing portfolio management — so you can build wealth without needing to become an investor yourself.

What kind of lending products can I access through MedInvest?

We have access to exclusive, profession-only loan structures designed specifically for medical professionals. These offer higher leverage, lower friction, and more favourable terms than standard public lending. They are tailored to your unique earning capacity and risk profile.

How does the ongoing portfolio support work?

After your initial investments are secured, we provide continuous strategic oversight. That includes reviewing your portfolio’s performance, identifying new opportunities, refinancing when appropriate, and helping you expand your holdings safely. You’ll have a dedicated team guiding your long-term financial trajectory.

What’s the first step to get started?

Your journey begins with a Private Wealth Strategy Session. In this session, we’ll review your income, goals, and tax profile, uncover how much you could be saving, and outline the exact roadmap to build long-term wealth. There’s no obligation — just clarity and strategy.

© Copyright 2025 YBR Edmondson Park. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Disclaimer: Results apply to each person based on their circumstances and current market situation

.